warning

All information presented in this article reflects the author’s personal opinion. The cryptocurrency market changes constantly, so the only advice is: think critically, do the math, and keep revising your long-term forecasts.

What does cryptography have to do with money?

Cryptocurrency is digital money whose issuance and circulation rely heavily on cryptographic functions and protocols. In particular, block generation uses one or more hash functions, while creating pseudonymous addresses (accounts) and transferring coins relies on public-key cryptography. This design gives cryptocurrencies properties fundamentally different from those of traditional (fiat) currencies and specialized online payment systems like WebMoney and Yandex.Money.

Who’s creating cryptocurrencies?

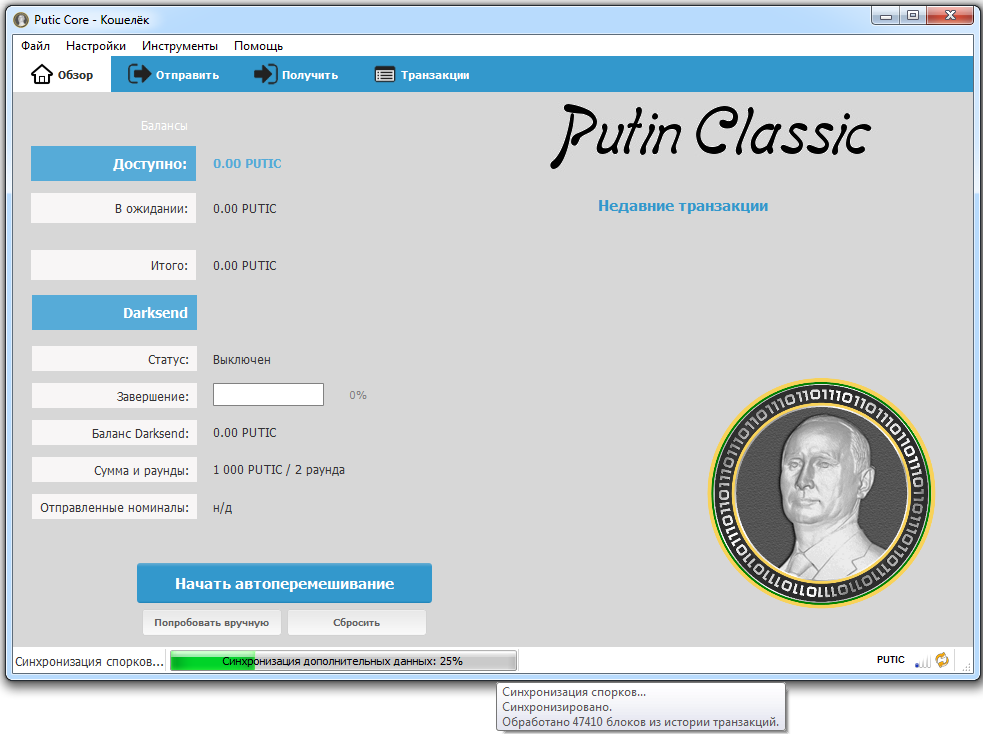

Right now, anyone can spin one up. The source code is on GitHub, and most altcoins are virtually identical—both in their underlying algorithms and in their wallet design. Most of these knockoffs have nothing behind them except a recognizable name. For example, there are cryptocurrencies named after Putin and Trump.

Why is everyone jumping into crypto mining?

Information sites about cryptocurrencies and thousands of YouTube videos have popped up. They walk you through mining step by step—clear enough for complete beginners. User-friendly wallets for all major operating systems and online custodial storage appeared, along with multi-currency exchanges and mining pools, accessible investment funds (with minimums as low as 0.001 BTC), and mining software that’s easy to get up and running.

As a result, the barrier to entry has dropped sharply over the past year. In the past, successful mining meant digging through tons of information yourself and launching, configuring (or better yet, writing) console tools and scripts in Linux; now there are GUI applications that handle almost everything for you. We’ll cover several of these tools in a separate article.

Why are cryptocurrencies only now going mainstream?

At first, cryptocurrency was just a quirky idea that lured geeks and technophiles with a whiff of high‑tech anarchy. Today, those virtual coins have suddenly become useful to a much wider audience—mostly because you can now exchange them for real money, goods, and services. And it’s not just hole‑in‑the‑wall cafés and entertainment sites; major companies like Dell and Microsoft are on board too—see the sidebar at the end of the article.

In the eight-plus years since Bitcoin’s debut, investors have come to see it and its peers as a kind of cyberpunk reboot of traditional securities. They’ve built an entire cryptocurrency industry, pouring in billions of dollars in the hope of making even more, fast. In 2009, a bitcoin wasn’t worth a penny—early trades priced it at 0.00076 of a cent—but today a single BTC goes for two and a half thousand dollars or more. At least, those were the exchange rates at the time of writing.

By early July this year, other cryptocurrencies were also on the rise, and as capital inflows grew, so did interest in them.

Ride the Wave!

According to the two largest analyst firms, IDC and Gartner, the current wave of cryptocurrency hype began in Q3 2016. That’s when a sharp spike in graphics card sales was recorded—especially notable against the broader slump in the PC market. GPU shipments grew by more than a third, while motherboard and CPU shipments fell by 4–5%. The obvious conclusion: most builds were using multiple GPUs, which is typical of mining rigs.

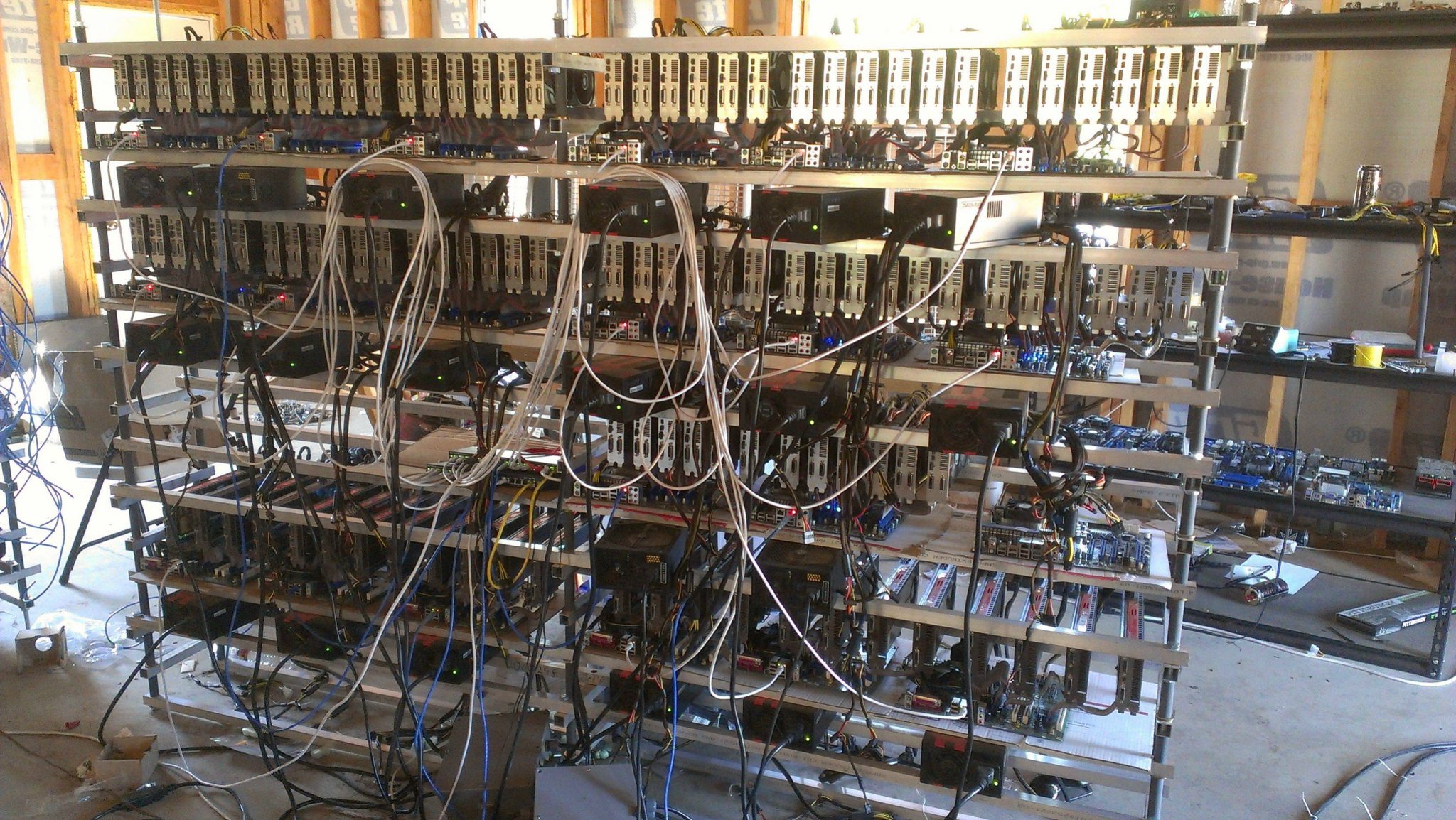

“Farms,” or rigs, are DIY clusters built around lots of GPUs used as accelerators for vector-style workloads. Typically they’re assembled from a grab bag of consumer parts with a low-end CPU (since it does very little of the computation) and a large number of gaming graphics cards. The GPUs are all hooked to a single motherboard via PCIe riser cables and PCIe x1-to-x16 adapters. This is cheaper than using high-end E-ATX boards with lots of full-length slots and professional accelerators. The extra features on pro-grade cards aren’t really useful for mining anyway. With the money saved, it’s usually better to add another GPU or invest in a higher-quality power supply.

Among these setups are some truly outstanding builds—compact, quiet, and energy‑efficient. Everything is overengineered, with meticulously designed power delivery and liquid cooling, and overall they look like supercomputer modules. Usually, such clusters are custom-built to tackle serious workloads in business, engineering, or scientific research, and they only switch to mining during idle time.

Most typical mining rigs are DIY builds thrown together with cost-cutting as the only guiding principle. Energy efficiency, electromagnetic compatibility, operational stability, component wear, and noise levels are all afterthoughts for the miner assembling the rig. They just spend all their cash on whatever hardware seems to fit (often second-hand with hidden defects), then mount it on a homemade open frame because it won’t fit into a standard case.

Before you start calculating the monthly—or worse, six‑month—profit from a rig like this, ask yourself why so many of them are up for sale. If you watch the price trends on avito.ru, you’ll see how fast they depreciate. The “farmer” will gladly show you how many altcoins or dollars his creation “earns” per day, and then try to unload it on you… for whatever he can get.

Why do people sell mining rigs?

The main reason behind the mining-rig craze—and the subsequent flipping of those rigs—is plain self-delusion. People avoid calculating the total cost of ownership, and instead just eyeball the power bill based on the GPU’s TDP. In reality, a GPU used for mining often pulls significantly more power than the spec sheet would suggest. And the “expenses” column should capture every mining-related cost: one-time direct costs (hardware purchase, shipping, setup of the equipment and software), ongoing operating expenses (electricity, internet, facility rent), and indirect costs (changes to how your split-system A/C runs, degraded working conditions due to noise, and so on).

At first glance, the tables in online profitability calculators are more confusing than helpful. They reflect calculations based on the current state of crypto networks, but that state changes constantly. Mining profitability fluctuates around an average from minute to minute. Several times a day it can swing noticeably—for example, dipping below the breakeven point for a while. In other words, during those periods you may literally pay more for electricity than you earn in block rewards.

Mining algorithms are generally designed to increase difficulty over time, since hardware keeps getting faster and more energy‑efficient. Every N blocks, the target threshold is tightened, effectively lowering the hashrate. In practice, however, the growth in mining difficulty has been far outpacing projections.

Riding the latest mining hype, more and more people are joining in, and the total hashrate of the cryptocurrency network grows faster than expected during these periods. As a result, each farm’s relative share of the hashrate inevitably falls, and its profitability declines.

How does mining work?

Mining is the process of creating a new block of data that records cryptocurrency activity and links to the previous block in the chain (the blockchain). It’s intentionally difficult: the protocol imposes a computational challenge. That difficulty serves as proof of work, which in turn earns the miner a reward.

In a nutshell, mining is about trying different values in the block header’s nonce field until the hash of the entire block meets the current difficulty target. For example, the target might require the hash to start with three leading zeros (producing something like 000413224AF6B6D3505DD1819D02491C34588DE7A4DC6A9AD48A8F7E08E2F7B). Each altcoin’s mining algorithm has its own specifics and may use different hashing functions.

The process is called “mining” because it’s like a miner in an open-pit mine: you have to sift through tons of worthless rock to find a few diamonds.

What are miners?

A miner can be a person who performs mining, or software that runs a mining algorithm. The term also refers to specialized hardware built for a single purpose: mining a cryptocurrency using a specific algorithm. These devices—often called ASIC miners—are faster than general-purpose CPUs and GPU farms while consuming less power, making them more cost-effective.

What’s the point of crypto mining?

Hash computations by themselves serve no practical purpose. They’re just a very elaborate way of turning electricity into heat. That said, the same could be said about many other popular pursuits.

The whole point of that tedious hash brute-forcing is that it acts as an anti-forgery mechanism, because it forces an attacker to perform resource-intensive work. Even forging a single block takes noticeable time, and a lone falsified block will be rejected by the network as invalid—other nodes have their own copies of the blockchain to verify against.

Forging the entire chain (or a long branch of it), where each subsequent block attests to the previous one, is extremely difficult. To do it, you’d need either colossal computing power or to overwhelm the distributed network with fake nodes—controlling just over half of them—so they accept the counterfeit chain as the canonical one.

For each valid block, the miner who finds it earns a reward. They usually reinvest the proceeds in more hardware to mine faster. The result is a self-reinforcing system (a positive feedback loop).

What types of cryptocurrencies are there?

There are now over a thousand of them, each with its own distinguishing features. Digging into minor differences is tedious, so we’ll focus on the core: hashing algorithms. They determine what hardware is best for mining a given cryptocurrency and how profitable it’s likely to be over time.

Beyond single algorithms, mining often uses multi-algorithm setups. For example, DigiByte (DGB) combines the hash functions SHA-256, Scrypt, Qubit, Skein, and Groestl, while SaffronCoin (SFR) uses SHA-256, Scrypt, Groestl, X11, and Blake.

Why do we need different hashing algorithms?

Most new cryptocurrencies use hashing algorithms and combinations specifically designed to prevent ultra-fast mining. Some make the use of application-specific integrated circuit (ASIC) miners uneconomical or even outright impossible. Others include defenses against large-scale mining farms and are intentionally designed to be mined without GPU acceleration. In some altcoins, planned obsolescence for GPUs is built in, tied to the GPU architecture or the amount of onboard memory.

In Ethereum, the DAG file grows every 30,000 blocks and has to fit entirely in each GPU’s memory. There are ethminer forks that try to work with a fragmented DAG, but they’re neither fast nor stable. As a result, rigs with 1 GB GPUs dropped out of Ethereum mining early on, and last year 2 GB cards followed. Many owners rushed to sell those rigs to buyers who hadn’t yet dug into the details.

All these limits are there to ensure that users with regular PCs and newcomers aren’t left behind.

Die-hard miners are few and far between, and their interest fades as quickly as it flares up.

Without a critical mass of consistently active nodes—run by everyday users—the network’s throughput will plummet. Transactions will take days to clear, and people will quickly abandon such a cryptocurrency. Competition in this space is extremely fierce.

What do you mine with?

- Using a cloud‑mining provider’s hardware;

- on ASICs;

- on GPUs with OpenCL/CUDA support;

- on general‑purpose CPUs (mostly x86‑64);

- on clusters of ARM single‑board computers (e.g., Raspberry Pi);

- and the truly unhinged “mine in their heads” until they get another dose of chlorpromazine (Thorazine).

What are ASIC miners?

ASICs, or simply “ASIC miners,” are high-speed mining devices built on application-specific integrated circuits. Their main advantages are top-tier energy efficiency and a compact form factor thanks to the absence of unnecessary components. Their main drawback is that they can mine only a single hashing algorithm (rarely with minor variations), so they become obsolete quickly.

There are dozens of different ASICs out there, and each could merit its own article. So we’ll provide a list of manufacturers and take a closer look at a few models as examples.

The cheapest ASIC for the Scrypt algorithm — G-Blade Miner — used to cost under $100, but it’s now only available on the secondary market. It draws about 100 watts and mines at 5–6 MH/s (million hashes per second), depending on how aggressively you tune it.

The fastest (so far) on the same algorithm is the Litecoin Scrypter PRO. It costs about $9,000 including shipping and mines at 900 MH/s without overclocking.

ASIC manufacturers:

- Advanced Mining Technology

- AlcheMiner

- Alpha Technology

- AsicMiner

- Avalon

- BitCrane

- BitFury

- Bitmain Tech

- Bitmine

- Black Arrow

- Butterfly Labs

- Gridseed

- HashCoins

- HASHRA

- INNOSILICON Technologies

- KFLminer

- MinersLab

- RusMiner

- Sfards

- SFminer

- Smart Heat

- Spondoolies-Tech

- XBTec

- Yes Miners (scammers)

- Yiazo

- Zeus Integrated Systems

For almost every company on the list, you could add a note: “The company has shown signs of unfair trading practices and is facing class-action lawsuits.” Among ASIC vendors there are also outright scammers. They lure novice miners with wildly inflated specs for non-existent devices, post 3D renders instead of real photos, and open preorders at attractive prices. Then, when the influx of trusting buyers dwindles, they simply disappear with the money.

An example of this kind of scam is “the fastest SHA‑256 miner — Yesminer M10.” The spec sheet claims it costs about $2,700, draws 800 W, and mines at up to 10 TH/s (terahashes per second). Obviously, that’s fake. Physics simply doesn’t allow that level of energy efficiency yet, even with superconductors. For comparison: the Bitcoin MINER T-720 costs $4,000, consumes 7.8 kW, and delivers 7.2 TH/s on the same SHA‑256 algorithm.

Other manufacturers take a simpler route. They open preorders for miners they’re actually building, but drag their feet on shipping. The “new” units first sit by the hundreds in some Uncle Liao’s warehouse, mining altcoins 24/7. Once mining stops being profitable (because the difficulty has gone through the roof), they ship them to customers—without even blowing the pounds of dust out of the heatsinks or replacing the burned-out hashboards.

Sure, there are some relatively honest sellers, but market realities mean no one will sell you a profit tool with fast, guaranteed payback. Buying ASICs only makes sense if you have free electricity and a place to install them in a utility or technical room. Most of them are as loud as vacuum cleaners.

When picking an ASIC miner, don’t compare hash rate at face value—the algorithm matters. On one algorithm, 50 MH/s is excellent; on another, it’s nowhere near top speed. Price and power draw don’t define performance either. A “more powerful” unit might just be older and built on a different process node.

What are the key secrets to successful mining?

In my view, it’s about balance and tight control. If you’re going to mine on your own hardware, use conservative, non-aggressive settings and run the ASIC or rig only when it’s profitable—e.g., at night if you have a time-of-use meter. Focus on stability. Power supplies and adapters aren’t where you save money. In cold weather, use your mining gear as a space heater (seriously), and don’t run it unnecessarily in the heat; a split-system AC will burn more power than you’ll ever mine. Keep an eye on conditions and sell in time—both aging hardware (while someone still wants it) and the coins you’ve mined (while the exchange rate is still favorable).

It’s often more cost-effective to buy a plan from a cloud mining provider than to build your own rig. At the very least, you avoid large upfront costs and can gain hands-on experience relatively cheaply.

Why does mining profitability keep dropping?

If you start mining on a stack of brand-new GPUs, especially during a bull run, the outlook will seem dazzling. At first it’ll look like the rig is pulling in tens of dollars a day and will pay for itself in no time. But don’t rush into long-term projections. The pace will drop, and you’ll feel like Achilles chasing the tortoise—never quite catching up. The break-even date will keep slipping, receding further and further over the horizon.

Cryptocurrency prices often plunge just as sharply after a surge, partly due to pump-and-dump dynamics. Every wave has a crest and a trough, and right now (in the first half of July) I’m anticipating the downturn to begin. At this stage, the winners will be those who cashed out at the peak. Their gains will come at the expense of those who jumped into mining at the wrong time.

Do past lessons still apply to crypto?

In the past it was the same story, just with smaller waves. Cryptocurrencies drew interest mainly from geeks and young investors who closely followed the IT market. They made up only a tiny fraction of the population, so the price swings weren’t as noticeable.

Sometimes plain old patience is the most profitable strategy. You ignore the day-to-day market swings and wait for your moment. People who casually mined a thousand or two bitcoins back in 2010–2011 and forgot about them suddenly found themselves rich in 2017—assuming, of course, they could still locate their wallet and remember the password after all those years.

Sometimes major mining pools experience forced downtime. When that happens, the network hash rate drops and each mining farm’s profitability temporarily spikes because competition falls. In those moments, some miners think their hopes have finally come true, while others rush to pump out YouTube videos to impress potential buyers with the farm’s fleeting, inflated profitability. Just remember: no one in their right mind sells the goose that lays the golden eggs. If they’re pushing it that hard, it’s only good for soup—and not a very tasty one.

Which cryptocurrency is the most profitable to mine?

The answer keeps changing. Bitcoin has been and remains the primary cryptocurrency. Its market cap has recently hovered between half and two-thirds of the entire crypto market, but mining it directly hasn’t been profitable for a long time. Typically, other coins (altcoins) are mined and then converted to BTC. Since altcoin prices and mining difficulty are unpredictable, miners tend to chase short‑term favorites.

For a long time, Litecoin was considered the “silver standard.” Recently, Ethereum took that spot, and soon after Litecoin even slipped to third, overtaken by Ripple (XRP). Significant funding is now flowing into promoting Dash, NEM, IOTA, and Monero.

A different story is new cryptocurrencies that start out worth pennies and are easy to mine, only to surge in price after a major funding round. But raising capital is hard, and most new coins remain amateurish projects with near-zero value.

For now, the only thing you can mine completely safely is NKK. This cryptocurrency was created by the well-known sci‑fi author, radio‑electronics engineer, and programmer Leonid Kaganov. Just visit the page on his website, and a new wallet will be created automatically and mining will start.

All other cryptocurrencies involve risks tied to upfront investment and ongoing costs (at a minimum, your time and electricity). If you’re short on cash but eager to try, opt for cloud mining—it’s the fastest way to start. Major cloud providers offer trial accounts that let you experiment with little to no cost.

Are cryptocurrencies a pyramid scheme?

The issuance and distribution mechanics of altcoins are hard to grasp, so people often map them onto familiar economic models. For example, the launch of a new cryptocurrency is likened to an initial public offering (IPO), and algorithmic increases in mining difficulty are compared to the construction of a pyramid scheme. If the first coins are easier to mine than later ones, those who start mining early are, in theory, in a more advantageous position.

However, Moore’s Law is still in play, and early adopters of altcoins take on even greater risk. The next cryptocurrency can just fade into obscurity, leaving its holders with nothing to show for it. That’s usually what happens.

Ponzi-like elements tend to appear only in cryptocurrencies where the developers performed a premine. The total coin supply is usually known in advance (it’s encoded in the protocol). If, before making the project public, the developers mine 10% or more for themselves, that’s a major red flag.

Of course, premining isn’t a clear-cut reason to dismiss a project, but it is a telltale sign that the cryptocurrency won’t start out as a truly decentralized, level-playing-field network of participants.

Survivorship Bias

In statistical analysis, there’s a concept called survivorship bias. Someone who’s made it through serious challenges starts sharing advice and warning others not to repeat their mistakes. Sounds great—except we overlook the fact that their mistakes didn’t end in catastrophe, and what you’re hearing is a success story. They survived despite the missteps; otherwise there’d be one fewer storyteller.

When the market really convulses (the dot-com bubble, financial defaults, and so on), those who made truly fatal errors leave the business—or worse. They won’t be giving any advice. So don’t blindly copy what others did. Your neighbor says he built a mining farm and made “100,500” altcoins doing nothing? Talk is cheap—you can say that too.

List of companies that accept cryptocurrency as payment

- 4Chan.org

- A Class Limousine

- Alza

- Amagi Metals

- Badoo

- BigFishGames.com

- Bitcoin.Travel

- Bitcoincoffee.com

- Bloomberg.com

- Braintree

- CEX

- CheapAir.com

- Crowdtilt.com

- CurryUpNow.com

- Dell

- Dish Network

- Dream Lover

- Etsy Vendors

- Euro Pacific

- Expedia.com

- ExpressVPN.com

- EZTV

- Famsa

- Fancy.com

- Fight for the Future

- Foodler

- Gap, GameStop, and JC Penney

- Grass Hill Alpacas

- Green Man Gaming

- Grooveshark

- Gyft

- Helen’s Pizza

- Humblebundle.com

- Intuit

- i-Pmart (ipmart.com.my)

- Jeffersons Store

- Lionsgate Films

- LOT Polish Airlines

- Lumfile

- Lv.net

- Mega.co.nz

- Mexico’s Universidad de las Américas Puebla

- Microsoft

- Mint.com

- MIT Coop Store

- MovieTickets.com

- mspinc.com

- Museum of the Coastal Bend

- Namecheap

- Naughty America

- NCR Silver

- Newegg.com

- OkCupid

- Old Fitzroy

- One Shot Hotels

- Overstock.com

- Pembury Tavern

- PizzaForCoins.com

- PSP Mollie

- PureVPN

- Rakuten

- RE/MAX London

- San Jose Earthquakes

- Save the Children

- Seoclerks.com

- SFU bookstore

- Shopify.com

- ShopJoy

- SimplePay

- Square

- State Republican Party

- Steam

- Straub Auto Repairs

- Stripe

- Subway

- Suntimes.com

- The Internet Archive

- The Libertarian Party

- The Pink Cow

- The Pirate Bay

- Tigerdirect

- T-Mobile Poland

- Virgin Galactic

- WebJet

- Whole Foods

- Wikipedia

- WordPress.com

- Yacht-base.com

- Zynga

How do you make money with cryptocurrencies?

The most realistic path is plain market speculation. Buy altcoins ahead of the next funding round and dump them when the price spikes. Scoop up GPUs, power supplies, risers, new ASICs, and other gear, then resell it to miners at a hefty markup. Buy cheap contracts from cloud providers with the goal of flipping the resulting altcoins. Finally, you can build your own product—your own cryptocurrency, app, mining pool, exchange, or a crypto-focused website—and monetize it.

Conclusion (for an extra fee :))

Over the years, some cryptocurrencies have become genuinely valuable, while others have devolved into penny-stock schemes pushed on unsuspecting investors via classic pump-and-dump tactics. First, demand for these obscure coins is manufactured: splashy marketing campaigns roll out, “new funding rounds” are announced, and multi-coin mining pools are flooded with orders to mine the token. Then, once the price is driven high enough, the insiders dump their holdings just as quickly, and the project is quietly shut down.

So start by mining one of the more stable, high–market-cap cryptocurrencies, and treat the others as just-for-fun bets—never invest more than you can afford to lose.

In most cases, mining on your own hardware barely breaks even on electricity costs. It only becomes profitable if you have essentially free resources or when cryptocurrency prices are inflated during another hype cycle. Cloud providers sell compute for a reason: it’s less profitable for them to do the mining themselves.

If building a mining rig no longer seems profitable and you’d rather put your idle hardware to work on heavy computations, take a look at Gridcoin or FoldingCoin. You’re unlikely to earn much quickly, but instead of cranking out useless hashes, your CPUs and GPUs will be crunching real scientific workloads and contributing to actual research.